In October we suggested investors take a position in Golden Valley Mines (TSX.v: GZZ) (GLVMF), which was an inexpensive way to own shares in Abitibi Royalties (TSX.v: RZZ) (ATBYF). Shares of Golden Valley have nearly doubled since then, but relative to the developments we’ve seen since then we believe that there is more room to run. As we’ve recommended that subscribers take some profits on a few names in a recent article, we’re further suggesting that proceeds can be redeployed in Golden Valley.

In the October article we recommended both stocks, but recent developments and inefficient markets suggest that Golden Valley is clearly the better choice. Having said that, in making an investment case for Golden Valley we will make one for Abitibi Royalties and note that major shareholders in each hold shares in the other. For instance Glenn Mullan, who is CEO of Golden Valley and Chairman of both companies, owns stock in both companies. Rob McEwen, who has made headlines with his recent addition of Abitibi Royalties shares (making him a ~12% shareholder), is a long-time shareholder in shares of Golden Valley.

Positive developments for Abitibi shareholders (and by extension, Golden Valley shareholders) include:

- Strength in Abitibi’s key stock holdings in Agnico Eagle Mines (AEM) and Yamana Gold (AUY).

- Agnico Eagle’s and Yamana Gold’s deployment of capital towards exploration of the Odyssey Zone of their Canadian Malartic JV, which is accelerating and further evidencing the two companies’ confidence in that project, on which Abitibi owns a 3% NSR.

As a result Abitibi shares have been quite strong. Rob McEwen’s added confidence and what has been an accretive stock repurchase program (a rarity in junior mining) have created additional demand for shares.

Golden Valley is an indirect beneficiary of these developments given that it owns 5.6 million shares of Abitibi Royalties. Based on Friday’s (7/29/16) market close this stake is worth ~C$43.8 million vs. a C$26 million market capitalization. Recall that in October that the valuation gap was much narrower and could be explained away by the theoretical tax liability that Golden Valley would face were it to sell its Abitibi shares, as well as the decreased Abitibi share price in the event of such a liquidation. But now the valuation gap is more substantial: Golden Valley shares would have to rise 68% in order to completely close it. Even if we don’t expect the gap to completely disappear considering the aforementioned tax liability and the impact of selling such a large block of stock into the open market, we could reasonably assume that the valuation gap can normalize to where it was prior to the recent disparity. As Glenn Mullan suggested it has risen from 25:1 (1 Abitibi share to 1 Golden Valley share) to 35:1, meaning that we can expect ~40% upside in Golden Valley shares alone, not taking into consideration the company’s other assets.

With respect to its other assets, this brings us to another major development in Golden Valley’s positioning, namely its exposure to Sirios Resources (TSX.v: SOI) (SIREF) through a 4.15 million share position (worth ~C$3 million) and a 2.5-4% NSR royalty on the company’s flagship Cheechoo Project, which has received a lot of attention lately given recent promising drill results and a capital injection into Sirios by Goldcorp (GG), which owns the nearby Eleonore Project. Newsletter writer John Kaiser has backed Sirios and the Cheechoo Project by extension. Cheechoo is still early in its development, and so investors shouldn’t get ahead of themselves, but at the very least Golden Valley now has nearly C$2 million in marketable Sirios shares, which are sufficiently liquid and in demand given the new-found optimism in Cheechoo.

Finally, Golden Valley has several early exploration projects, and up until very recently it has been an explorer and prospect generato. However, given its holdings in Abitibi, Sirios, and the Cheechoo royalty, Golden Valley is in the process of restructuring into an investment holding company. The fact that it isn’t yet sheds light on one of the issues that may be holding shares back, namely the fact that Golden Valley has to pay to keep its exploration property claims in good standing. Negative cash-flow cheapens the values of royalties (Aurico Metals shareholders are all too familiar with this issue) and investments, which may have to be divested in order to make payments. The good news is that Golden Valley’s management recognizes this issue, and is searching for a way to eliminate these liabilities. As a prospect generator the natural path would be to find JV partners for these projects, retain cash or royalties, and shift the claim maintenance liabilities to its JV partners. Another option would be to spin out the exploration companies into a “SpinCo” or into several SpinCos, and to retain royalties and possibly an equity stake in the SpinCo (this is how Golden Valley spawned Abitibi Royalties, Nunavik Nickel (TSX.v: KZZ) (NNVKF) and Uranium Valley Mines (TSX.v: VZZ) (URANF)). The point is that, in the near future, we should expect some development or series of developments that eliminates the liability of holding mineral claims and re-brands the company as an investment holding company, and this should be a positive catalyst.

Why Abitibi Royalties Still Looks Attractive

Golden Valley Resources’ primary asset is its ~5.6 million share investment in Abitibi Royalties. Note also that Glenn Mullan–CEO and Chairman of Golden Valley–is also Chairman of Abitibi Royalties and holds nearly 200,000 shares of the company in addition to his indirect holdings through his Golden Valley shareholdings. So there is a lot of overlap.

Abitibi Royalties’ CEO Ian Ball has made it his goal to turn Abitibi Royalties into “the best” gold company, and given its share performance over the past few years one can make the case that it is in the running for that title. The company’s most valuable assets are its shareholdings in Agnico Eagle and Yamana Gold, which it received as part of its compensation package provided in exchange for land holdings which were critical in developing the Canadian Malartic Project–now one of Canada’s largest and most profitable gold mines. In addition, the company holds royalty claims on various parts of the land package encompassing the Canadian Malartic Project. Less significant are the royalties the company has purchased on land packages near major deposits/mines. As CEO Ian Ball has said, they are “lottery tickets” that have the potential to generate enormous returns but which have no quantifiable value now.

When we first recommended shares of Abitibi Royalties we noted that the value of its share holdings in Agnico Eagle and Yamana Gold alone justified the company’s valuation, and that the royalties were like free call options. The Canadian Malartic royalties were especially promising, and discussions with management revealed that there was potential for near-term production from the Jeffrey Zone in 2017, and the Barnat Zone in the following year. Each zone has a small delineated resource as specified on the map.

(Source: Golden Valley’s Presentation)

Each of these zones would result in a couple thousand ounces of attributable production for Abitibi Royalties and they admittedly don’t move the needle much for Abitibi Royalties at the current valuation without resource expansion.

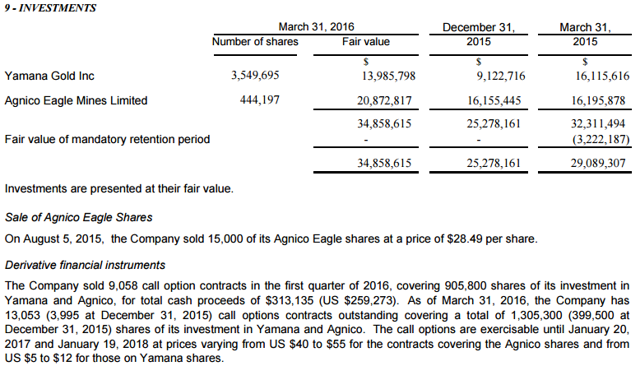

Abitibi shares have outperformed both Yamana and Agnico shares, so more value is being ascribed to the royalties, as we had predicted. Furthermore, note that Abitibi has sold call options on its holdings in these two companies. We aren’t provided with specifics, but based on statements found in the company’s Q1 financials it is clear that some of its exposure has been offset by the sale of call options.

Given current share prices all of the calls sold up to March 31st (we assume the company has sold more as this is one of its cash-flow generation strategies) in Agnico Eagle, and many of the calls sold on Yamana Gold, are in the money, meaning Abitibi doesn’t have exposure to the upside on those shares anymore. According to the company’s latest corporate presentation its exposure to both Agnico and Yamana is ~C$54.9 million, with Agnico shares having risen ~10% since then and with Yamana shares up slightly. With an C$82 million market capitalization and <C$3 million in working capital it is clear that the market is now ascribing more value to the royalties, and with good reason.

The major development that has merited this has been at the Odyssey Zone, which is a longer term opportunity that is being explored aggressively this year. Golden Valley’s and Abitibi’s managements were expecting an aggressive $8 million drill program at Odyssey that would be capped off by an internal scoping study by the end of the year. Both Agnico and Yamana have just released their Q2 results and updates and there is good news for Abitibi/Golden Valley shareholders. Yamana, in its July 29th conference call, told us the following:

And that’s not all, we see additional upside at Canadian Malarctic with Odyssey, the Odyssey deposit. We announced promising drill results from Odyssey. We have allocated more resources to exploring Odyssey. Odyssey has the potential to become an ongoing improvement part of the ongoing other improvements to the mine life and the mine plants in Canadian Malarctic. Now picking up on that theme of creating value we’re really pleased with the progress we’ve made with C1 Santa Luz.

…

The goal of the 2016 program was to complete a 100 by 100 meter spaced drill program to establish an inferred mineral resource. That initial program is complete and has successfully established the initial size, shape, grade and bulk tonnage deposit. Additional funding has been allocated just recently by the management committee to continue to drill the program – the drill program through the end of the 2016.The extra 5.5 million Canadian will allow the geologist to complete an additional 35,000 meter of infill drilling concentrated on at least two zones within the North mineral deposits.

The initial infill program will — also encountered three unexpected high-grade mineral intercepts the other peers strike north-south crosscutting the east-west trending main Odyssey deposit. These structures will also be further drilling to be completely understood.

3 high-grade targets and an additional 35,000 meters of drilling is very promising, and while it won’t move the needle much for Agnico and Yamana it is a potential game changer for Abitibi Royalties–owner of a 3% NSR royalty on Odyssey–and Golden Valley by extension. The fact that Agnico and Yamana are accelerating the exploration program can only mean that recent results were better than expected. As described by Agnico Eagle in their July 27th PR:

Odyssey prospect at 50%-owned Canadian Malartic mine – Drilling outlines significant areas of mineralization in the North and South Odyssey zones – In the first half of 2016, 57 drill holes were completed, continuing the investigation of the Odyssey prospect. Recent drilling continues to return significant intercepts such as 2.63 g/t gold (capped) over 33.5 metres estimated true width at 1,138 metres depth in drill hole ODY16-5039, showing similarities to the Goldex mine deposit. Additional drilling totalling C$5.5 million (35,000 metres) has been added to the original budget of C$8.0 million (60,000 metres) (on a 100% basis).

This optimism not only speaks to the potential size of the resource, but it also suggests that Agnico and Yamana will prioritize Odyssey as it develops its overall Canadian Malartic mine plan.

A Couple of Risks To Consider

There are two things to keep in mind regarding Abitibi that investors should consider. The first is that its most valuable royalties–that is, those held on land adjacent to Canadian Malartic–have little predictable value given currently delineated resources. The biggest–Barnat East–contains just over 100,000 ounces, which on a 3% NSR basis comes down to ~$4 million without taking into consideration the time-value of money, taxation, and other expenses related to receiving this cash-flow. Recent optimism amongst Abitibi investors comes from developments at Odyssey, on which Agnico and Yamana have delineated no resources, meaning the opportunity is impossible to quantify.

Also note that while we can infer that Odyssey is a high priority zone, Abitibi has no say in when the resource is brought into production. We expect to have more information in Q1 2017 when Agnico and Yamana plan to complete their internal scoping study, and given the cost of resource expansion and Agnico’s/Yamana’s optimism this should be a positive catalyst, but we can at best infer this point for the time being.

Second, insider ownership at Abitibi is below our 10% threshold at 4%. However, there are several caveats that allow us to overlook this.

- Abitibi’s CEO Ian Ball takes his salary in stock.

- Shareholders in Golden Valley are indirectly shareholders in Abitibi. Glenn Mullan, who is chairman of Abitibi, effectively holds more than 200,000 shares in Abitibi indirectly through his holdings in Golden Valley. Insider ownership at Golden Valley is ~20% or 31% fully diluted. While some officers and directors at Golden Valley are not insiders of Abitibi, they do have influence over Abitibi given Golden Valley’s large stake and can be considered de facto insiders at Abitibi. As a result we can argue that Abitibi does have 10% insider ownership.

- The 10% threshold was set for small companies, while Abitibi’s market capitalization is ~C$83 million, which is multiples of the valuations of companies we’ve been focusing on. While insider ownership may fall short on a percentage basis it is very strong on a total value basis.

Why Buy Golden Valley

Given the valuation gap between Abitibi and Golden Valley it makes sense to buy Golden Valley for the time being on the premise that Golden Valley’s management will be able to close the valuation gap between the two companies. This is, in fact, one of the primary goals of the company, which recently brought on capital markets expert Jimmy Lee as a director. Lee is a >10% shareholder and has been buying shares on the open market, suggesting that he is confident that the valuation gap will close and further that Abitibi Royalties is an attractive investment proposition.

We also noted several additional investments held by Golden Valley, and complete the list here:

- 5.6 million shares of Abitibi Royalties worth C$43.8 million

- 4.15 million shares of Sirios worth C$3 million

- 37.4% of Uranium Valley Mines, worth C$0.67 million

- 60% of Nunavik Nickel, worth C$1.1 million

- C$1 million in cash/equivalents

Putting aside the fact that these assets aren’t necessarily liquid in sufficient quantities for Golden Valley to divest them in the current market environment, the total valuation here is ~C$48 million, or nearly twice the company’s current market capitalization.

Unfortunately none of the shares are sufficiently liquid for us to assume full valuations in today’s market with the exception of Sirios. Uranium Valley Mines and Nunavik Nickel are little more than shells at this point in time. We suspect that the value gap between Golden Valley’s portfolio and its market capitalization can close as the assets become more liquid, and while the company has plenty of liquidity the lack thereof in the Abitibi shares will likely scare off some investors or push them directly into Abitibi. Even though this ironically creates more liquidity in the shares the sheer size of Golden Valley’s stake means that it is, as a whole, always illiquid. Ultimately this means that Golden Valley will have to divest most of its position in Abitibi in order to improve its liquidity and to generate investor interest at/near the fair market value of its investment portfolio. But we believe that management wants to hold onto its position until more is known about the potential at Odyssey, as this should boost the shares.

Thus, on the one hand we have a company trading at roughly half the value of its marketable assets (excluding the Cheechoo royalty or the exploration assets), but it could take some time for the market to close this gap.

Given the size of this gap, and given the potential value in holding onto Abitibi shares for the Odyssey royalty (the risk of which is mitigated by the company’s stock holdings in Agnico and Yamana), Golden Valley shares are attractive. In the short-term, however, this is an investment that requires monitoring for the following:

- We want to make sure that Golden Valley’s management continues to develop as an investment company and want to see divestments and spin-outs of exploration assets. The company has cash as well and we would like to see it make investments.

- We want to track the disparity between Golden Valley and Abitibi shares. While we generally do not want to trade the discount in Golden Valley shares can shrink, or even become a premium, creating opportunities to trade from one stock to the other.

- We want to monitor developments at Odyssey. Golden Valley’s management is waiting to see how this unfolds. Either way–good or bad–we anticipate some diversification away from Abitibi once the market has priced in more advanced numbers out of Odyssey.

Category:

Tags:

AEM, ATBYF, AUY, GG, GLVMF, NNVKF, SIREF, TSX.V: GZZ, TSX.v: KZZ, TSX.V: RZZ, TSX.v: SOI, TSX.v: VZZ, URANF

The post, Double Down On Golden Valley Mines, first appeared at Mining Wealth.

Visit Gold Silver Intel for more.

source http://goldsilverintel.com/double-golden-valley-mines/

No comments:

Post a Comment